20+ paycheck calculator wyoming

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Wyoming residents only. For 2022 Wyoming unemployment insurance rates range from 009 to 85 with a taxable wage base.

How To Negotiate Salary Check City

The Wyoming Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Wyoming State.

. This tool has been available since 2006 and is visited by over 12000. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your. Calculate your Wyoming net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Wyoming.

Sin 2 theta calculator. Make Your Payroll Effortless and Focus on What really Matters. Just enter the wages tax withholdings and other information required.

Our paycheck calculator is a free on-line service and is available to everyone. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

2000 salary example for employee and employer paying Wyoming State tincome taxes. Wyoming Hourly Paycheck Calculator. Notre dame net price calculator.

This income tax calculator can help estimate your average income. Wyoming has a population of under 1 million 2019 and is the least populous state in the United States. No personal information is collected.

The main drivers of Wyomings economy are tourism and the extraction of. Need help calculating paychecks. It is not a substitute for the advice.

Ad Compare 5 Best Payroll Services Find the Best Rates. Detailed salary after tax calculation including Wyoming State Tax Federal State Tax Medicare. Wyoming Hourly Paycheck and Payroll Calculator.

The state income tax rate in Wyoming is 0 while federal income tax rates range from 10 to 37 depending on your income. Use ADPs Wyoming Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. As an employer you have to pay the states unemployment insurance.

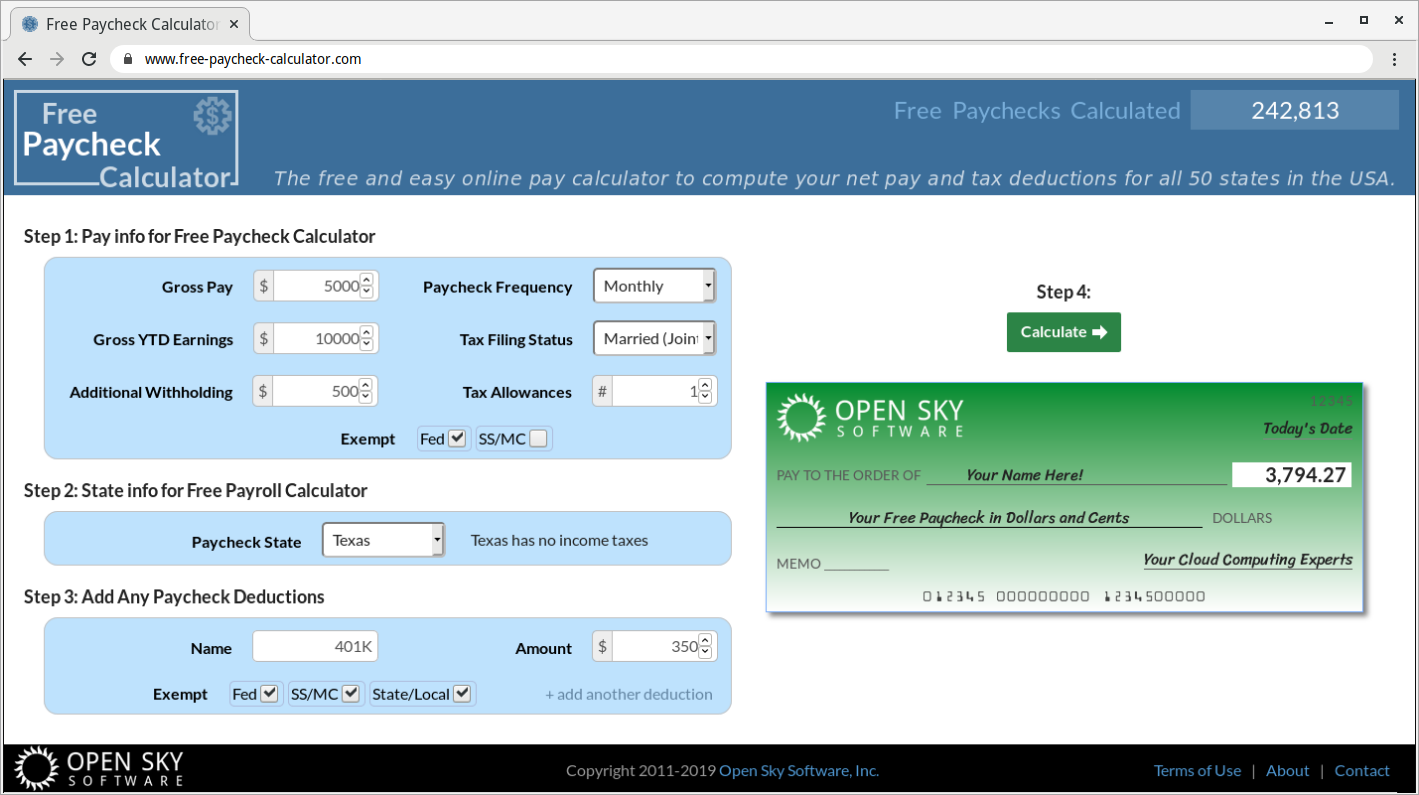

About Free Paycheck Calculator

Wyoming Hourly Payroll Calculator Wy Hourly Payroll Calculator Free Wyoming Paycheck Calculators

Free Paycheck Calculator Hourly Salary Usa Dremployee

Wyoming Bighorn Sheep Hunting Draw Odds Tags Season Info Deadlines And Results

Dunbar Woods Apartments 1000 36th St Sw Wyoming Mi Rentcafe

Ultra Home Internet Internet Coverage Availability Map

Tip Tax Calculator Primepay

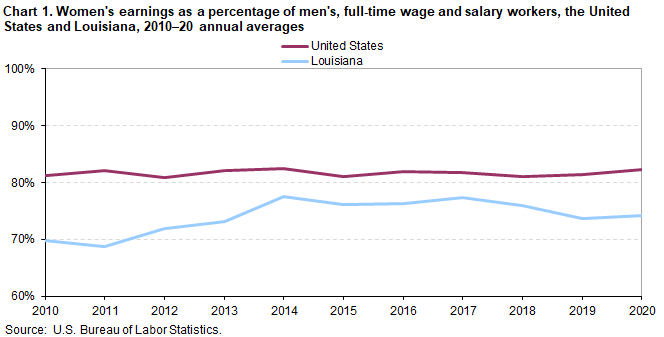

Women S Earnings In Louisiana 2020 Southwest Information Office U S Bureau Of Labor Statistics

Nightforce Elr Steel Challenge Precisionrifleblog Com

New Tax Law Take Home Pay Calculator For 75 000 Salary

Wyoming Bison Hunting 2022 Draw Odds Tags Season Info Deadlines And Results

Free Interpretation Skills Development Pilot Project To Launch Seisware

Horse Racing In Wyoming The Best Wyoming Horse Racing Betting Sites

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Paycheck Calculator Take Home Pay Calculator

Wyoming Income Tax Calculator Smartasset

Net Pay Definition And How To Calculate Business Terms